Alice Roach

Senior Research Associate, Applied Social Sciences

Mallory Rahe

Associate Extension Professor, Agricultural Business and Policy

Ryan Milhollin

Assistant Extension Professor, Agricultural Business and Policy

Joe Parcell

Professor, Agricultural Economics; Director, Center for Risk Management Education & Research; Kansas State University

Grant programs allow agricultural businesses and farmers to seek funding that supports business development and may complement other business financing. Grant funding is intended to serve as a short-term infusion of funds to either plan a business or grow an existing business.

Grants are different from other funding sources. Unlike loans, grants don’t require the recipient to repay the awarded funding. However, grant programs typically require recipients to make progress toward goals and submit reports to stay in good standing.

Grant programs focused on agricultural business development fund different purposes. Two common types are business planning and working capital; however, some grant programs may fund other expenses such as those for business implementation, equipment, training or research and development.

- Business planning projects help with exploring new business ideas and evaluating business concept feasibility. Deliverables funded by planning-focused projects include feasibility studies, market studies and business plans. In some cases, grant programs require an independent consultant to do the project work; the third-party perspective offers a more unbiased view of feasibility and market potential.

- Working capital projects offset startup and operational expenses related to objectives such as scaling the business, increasing sales, introducing new products and reaching new markets.

To be considered for funding, an applicant typically submits a proposal to a grant program in advance of a defined deadline. The applicant may prepare the proposal or hire a grant-writing specialist on a fee-for-service basis. Most grant programs have limited funding available to disburse. Applicants need compelling proposals to “compete” for funds.

Federal and state government agencies administer grant programs. This publication introduces those that prioritize agricultural business development, and it provides tips for developing and submitting strong proposals to grant programs that match your needs. Always carefully read program guidelines, which are subject to change.

Federal grant programs

The U.S. Department of Agriculture (USDA) serves as the primary federal agency that offers business development grant funding to agribusinesses and producers. These grantmaking efforts set USDA apart from other federal agencies.

See Table 1 for a list of federal grant programs that offer business development support to farmers and agricultural businesses. Review the following summaries to find a program that best meets your funding needs.

Table 1. Federal grant programs funding agricultural business development projects.

| Program and agency | Program purpose | Eligible applicants | Eligible expenses | Maximum funding | Other notes |

|---|---|---|---|---|---|

| Value-Added Producer Grant (VAPG), USDA Rural Development | Encourages new or expanded value-added agricultural activities focused on processing and marketing | Producers, producer groups, cooperatives or majority-controlled producer-based businesses | Planning projects fund work such as feasibility studies and business plans; working capital projects fund processing, marketing and advertising costs and some inventory and salary | $75,000 for planning grants; $250,000 for working capital grants | Match is required; amount varies based on federal funding decisions; applicants must register in the System for Award Management (SAM) |

| NCR-SARE Farmer-Rancher Grant Program, USDA National Institute of Food and Agriculture | Focuses on on-farm research, demonstration and education projects related to sustainable practices | Farmers and ranchers as individuals or teams | Research, demonstration and education project expenses; grant funds only pay up to half of equipment, permanent fencing, perennial seed and plant and livestock costs | $15,000 for individual applicants; $30,000 for team applicants | Letter of support required; no match required |

| NCR-SARE Partnership Program, USDA National Institute of Food and Agriculture | Enables applicants to pursue on-farm research, demonstration or education projects related to economic, environmental and social sustainability | Agricultural professionals (e.g., university or extension personnel, USDA NRCS staff, consultants, nonprofits) apply; they must partner with at least three farmers or ranchers who take an active role in the project | Project materials and supplies; equipment less than $5,000; field samples; crop analysis; surveys; farmer and rancher reimbursement; project travel; outreach costs; agricultural professionals’ services costs | $50,000 | Indirect costs limited to 10% of total federal funds awarded |

| Small Business Innovation Research Grant Program (SBIR), USDA National Institute of Food and Agriculture | Funds private-sector, early-stage research for products and services with commercial potential and societal benefits | Small businesses with fewer than 500 employees | Research and development to test an innovation’s technical feasibility; costs can include salary, materials and prototype expenses | $175,000; $181,500 if request includes technical and business assistance; later, Phase 1 recipients can apply for up to $650,000 in Phase 2 funding | No match required; 8-month project period; federal priorities change annually; letter of support encouraged |

| Farmers Market Promotion Program (FMPP), USDA Agricultural Marketing Service | Supports farmers working collectively with coordination, technical assistance and training to develop or expand producer-to-consumer markets | Agricultural businesses, producer associations, cooperatives, regional farmers market authorities, nonprofits and other entities; project must benefit more than one producer | Capacity building projects fund market analysis, strategic planning, training, market operation or expansion, tool development; community development training and technical assistance projects fund marketing and promotion, network-building and technical assistance | $250,000 for capacity building; $500,000 for community development training and technical assistance | 25% cash or in-kind match required; need signed letters of commitment and letters verifying match |

| Local Food Promotion Program (LFPP), USDA Agricultural Marketing Service | Invests in coordination, technical assistance and training to develop or expand intermediary markets for producers | Agricultural businesses, producer associations, cooperatives, regional farmers market authorities, nonprofits and other entities; project must benefit more than one producer | Planning projects fund feasibility studies, market research, training and technical assistance; other projects fund costs for personnel, software, food safety, equipment leases, business strategy and optimization | $100,000 for planning projects; $500,000 for implementation or farm-to-institution projects | 25% cash or in-kind match required; need signed letters of commitment and letters verifying match |

| Regional Food System Partnerships Program, USDA Agricultural Marketing Service | Supports partnerships dedicated to local or regional food system development | Producers, cooperatives, producer groups, community supported agriculture networks and associations, food councils, local governments, nonprofit and public benefit corporations, regional farmers market authorities or tribal governments; must partner | Eligible expenses vary by project type: planning and design, implementation and expansion or farm-to-institution | $100,000 to $1,000,000, depending on project type | 25% cash match of federal funds awarded |

Value-Added Producer Grant

To support applicants in producing or marketing value-added agricultural products, USDA’s Value-Added Producer Grant Program (VAPG) offers planning and working capital funding. USDA will award as much as $75,000 for planning projects and $250,000 for working capital projects. If requesting at least $50,000 in working capital funding, then USDA requires documentation that the business has financial feasibility or planned direction for marketing activities. Applicants should demonstrate how their projects address the program’s goals to offer new products, develop markets and generate more producer income.

You would be eligible to request and use VAPG funds to focus on a product if the product meets at least one of the following five value-added criteria:

- It changes physical state as you add value (e.g., make jam from berries).

- It’s produced through a process that adds value (e.g., organic, grass-fed).

- It’s physically segregated from other products (e.g., identity-preserved grain).

- It’s a form of renewable energy generated on the farm (e.g., ethanol from corn).

- It’s produced and sold locally (e.g., local beef).

Independent producers, producer groups and majority-controlled producer-based ventures may request VAPG funds. USDA assigns priority points for beginning farmers and ranchers, veteran farmers and ranchers, socially disadvantaged farmers and ranchers, small and mid-sized family farm operators, farm or ranch cooperatives, mid-tier value chain projects or producer groups representing these producers.

NCR-SARE Farmer-Rancher Grant

As individuals or teams, farmers and ranchers may apply for Farmer-Rancher Grant Program funding from North Central Sustainable Agriculture Research and Education (NCR-SARE). Eligible projects must involve research, education or demonstration and a topic linked to economic, ecological or social sustainability. Example topics related to business development include new farmer and rancher education or mentoring, farmland access, labor issues and value-added and direct marketing. All projects must have an outreach component — for example, field days, workshops, publications and social media content. Successful projects also include cooperators, such as extension educators, nonprofit organizations or conservation districts.

NCR-SARE Partnership Grant

The NCR-SARE Partnership Grant Program supports on-farm research, demonstration and education activities that connect to three tenets of sustainability: economic, environmental and social. Two-year projects may address topics such as marketing, processing, adding value to farm products and agricultural system resiliency. A funding request’s budget may total as much as $50,000. Indirect costs may not total more than 10% of federal funds awarded.

The program makes funding available to agricultural professionals, including university and extension educators, USDA Natural Resources Conservation Service (NRCS) staff, agricultural consultants and local nonprofits and other agencies that serve farmers and ranchers. However, these professionals must substantially involve at least three farmers or ranchers in project development and implementation.

Small Business Innovation Research Program

The USDA Small Business Innovation Research (SBIR) Program targets assistance to food, agriculture and rural community innovations. Projects eligible for SBIR funding involve research and development activities primarily carried out by small businesses, which use funding to explore ideas with high technical risk and significant commercial impact or societal benefit. Proposed projects must align with priorities in one of 10 topic areas named by USDA. Topic area examples include rural and community development and small and mid-sized farms.

USDA makes SBIR funding available in two phases. Phase 1 funding covers costs (e.g., salary, materials, supplies) used to determine whether a product or service is technically viable. In a Phase I proposal, applicants may request as much as $6,500 for technical assistance, such as a feasibility study, marketing study or business plan, in addition to requesting as much as $175,000 for research and development. Only available to projects that receive Phase 1 funding, a Phase 2 funding request may focus on commercializing products and services.

Farmers Market Promotion Program

The USDA Agricultural Marketing Service supports developing, coordinating, expanding and improving direct marketing of local and regionally produced agricultural products through the Farmers Market Promotion Program (FMPP). FMPP includes two types of grants. Capacity building grants assist markets with improving organizational capacity or the capacity of producers who sell at a market. Community development training and technical assistance grants fund outreach, training and technical assistance. To be eligible, markets must serve more than one producer. Examples include farmers markets, collaborative CSAs, online markets and agritourism initiatives.

Local Food Promotion Program

Administered by the USDA Agricultural Marketing Service, the Local Food Promotion Program (LFPP) focuses on developing and expanding intermediated markets that connect consumers to local food. It requires funded projects to benefit more than one producer. Intermediated local food markets include food hubs, food incubators and shared use kitchens.

LFPP offers three types of grants: planning, implementation and farm to institution. Planning grants fund feasibility studies, technical assistance and training, business plans and other planning-related efforts. Implementation grants allow recipients to invest in hiring personnel, providing food safety certifications and producer training, optimizing transportation networks or achieving other efficiencies. Farm-to-institution grants support efforts that seek to expand local food access to schools, hospitals and government-owned facilities. Grant funds can support aggregation, processing, distribution, storage and other costs.

Regional Food System Partnerships Program

Through the Regional Food System Partnerships Program, USDA invests in public-private partnerships focused on local and regional food system development. Ultimately, the program seeks to improve food economies’ viability and resilience in particular local areas or regions. To receive funding, a project must demonstrate that it has innovative financial and technical capabilities, assembles public-private partners that will collaborate well, offers a sustainable solution to meeting project goals and has the ability to measure results.

Producers, farm and ranch cooperatives and producer networks or associations are among the eligible applicants. USDA prioritizes projects submitted by applicants that form partnerships. Possible partners include groups such as state or regional agencies, nonprofits, higher education institutions, lenders or private corporations. Priority is also provided to projects that leverage nonfederal funds and resources, coordinate with other efforts and create potential for high impact in low-income communities with persistent poverty.

Missouri grant programs

The Missouri Department of Agriculture and Missouri Agricultural and Small Business Development Authority (MASBDA) offer grant funding to producers, agricultural businesses and other eligible applicants. The following summaries and Table 2 describe several state programs available.

Table 2. State grant programs funding agricultural business development projects.

| Program and agency | Program purpose | Eligible applicants | Eligible expenses | Maximum funding | Other notes |

|---|---|---|---|---|---|

| Missouri Value-Added Agriculture Grant, MASBDA | Supports studying and planning value-added agricultural business concepts | Producers, groups, businesses or organizations | Feasibility studies, business plans, marketing plans, organizational or legal assistance | $200,000 | Application fee required; 10% match required; budget must include a 10% grant administration fee; tax credits must fund at least 50% of grant request |

| Missouri Farm-to-Table Grant, MASBDA | Provides resources used to process locally grown agricultural products sold to institutions | Farms or small businesses marketing locally produced value-added goods to Missouri institutions | Coolers; freezers; equipment for washing, bagging or packing; GAP, GHP and HACCP services | $200,000 | Application fee required; 10% match required; budget must include a 10% grant administration fee; tax credits must fund at least 50% of grant request |

| Show-Me Entrepreneurial Grants for Agriculture, MASBDA | Technical assistance grants support hiring third-party professionals to support business development priorities | Individual, groups of individuals, businesses or organizations | Marketing costs (e.g., website development, slotting fees, e-commerce planning costs) and select consulting fees | $7,500 | 25% cash match required |

| Innovation grants focus on expanding infrastructure needed to increase value-added agricultural production | Producers, businesses, nonprofits, cooperatives or academic institutions | Facility and equipment investments or other upgrades | $250,000 | 25% cash match required | |

| Workforce development grants support value-added businesses in meeting labor needs | Individual, groups of individuals, businesses or organizations | Employee hiring, training or certification | $5,000 | 25% cash match required | |

| Process authority fee offset | Missouri value-added agricultural enterprises | Process authority services (e.g., product testing, process authority letter) | $250 | Reimbursement sent directly to process authority | |

| Specialty Crop Block Grant, Missouri Department of Agriculture | Funds projects meant to grow specialty crop markets, distribution and competitiveness; projects must benefit the industry or public, not only one individual, business or organization | Individuals, producers, nonprofits, for-profit businesses, colleges and universities, agencies, institutions, industry groups or community-based organizations | Specialty crop research, food safety, pests and diseases, education, marketing or promotion | $50,000 | $15,000 maximum on total personnel and fringe benefits expense |

| Food Insecure Cost-Share Grant, Missouri Department of Agriculture | Increases the availability of food within food-insecure urban areas located in Missouri | Individuals, businesses or organizations related to agriculture | Materials and equipment used for facility expansion, building or reconstruction; approved project supplies | $50,000 | Program will reimburse 75% of total approved project costs |

| Urban Agriculture Cost-Share Grant, Missouri Department of Agriculture | Encourages small agribusiness development in urban areas | Project teams working in Missouri urban areas | Equipment, materials, business plans, marketing, supplies | $10,000 | Program will reimburse 75% of total approved project costs |

Missouri Value-Added Agriculture Grant

Open to producers, groups, organizations and businesses interested in adding value to agricultural products in Missouri, the Missouri Value-Added Agriculture Grant Program funds expenses incurred to study and plan value-added agricultural business concepts. The program is meant to get a project to the point of seeking operational financing.

Awarded funds may pay for feasibility studies, marketing studies or plans, business plans, operational consulting and legal assistance. MASBDA administers the program, which is targeted to increase markets for Missouri agricultural products and stimulate rural economic development. Priority is given to projects that benefit multiple producers and those that are innovative and have potential to achieve near-term impacts.

An applicant may request up to $200,000 in grant funding. Applicants pay a fee when submitting their proposals, and recipients must match 10% of awarded funds. Additionally, recipients must commit to buy tax credits or secure tax credit purchase agreements equal to half of the requested grant amount.

MASBDA has funded value-added grants since 1999. Some include statewide industry support projects targeted to benefit stakeholders throughout Missouri. These studies compile research-based information that producers and agribusinesses can use as they consider particular value-added business opportunities. These studies are available online for you to review.

Missouri Farm-to-Table Grant Program

Institutions, such as schools, correctional facilities, hospitals, nursing homes and military bases, represent markets for locally produced foods. Administered by MASBDA, the Missouri Farm-to-Table Grant Program provides funding for Missouri farms or small businesses selling locally produced value-added products to institutions in the state.

The program funds eligible capital expenses (e.g., equipment for cooling, freezing, cleaning, bagging and packaging) needed to prepare local foods for institutional sales. Some planning expenses, such as those related to food safety, are also allowable. MASBDA prioritizes projects that exhibit strong potential for economic development and near-term success. Projects may request up to $200,000 in grant funding. Applicants pay a fee when submitting their proposals, and recipients have a 10% cash match requirement. Additionally, recipients must commit to buy tax credits or secure tax credit purchase agreements equal to half of the requested grant amount.

Show-Me Entrepreneurial Grants for Agriculture

Administered by MASBDA, Show-Me Entrepreneurial Grants for Agriculture (SEGA) accelerate investments in value-added agriculture infrastructure, training, business support and product commercialization. To be competitive, projects must demonstrate potential to accomplish the following: create near-term impact, enhance value-added sales, increase employment and expand use of Missouri-raised agricultural products.

SEGA funds business development activities through the following programs:

- Innovation grants award as much as $250,000 per project to fund facilities, equipment and upgrades to expand value-added agricultural production; 25% cash match required.

- Technical assistance grants fund marketing expenses, such as slotting fees and website development costs, and consulting fees paid for federal grant application preparation, business structure assistance and transition planning. Applicants may request as much as $7,500 per project. If they receive funding, then they must provide a 25% cash match.

- Workforce development grants provide as much as $5,000 per request to support businesses with hiring, training and certifying new employees working in a value-added agricultural business. A 25% cash match is required.

- MASBDA also will award funds to offset the cost of process authority services, which include testing food products for safety and providing letters of process authority approval. An applicant may qualify for expenses up to $250.

Specialty Crop Block Grant

Administered by the Missouri Department of Agriculture, the Specialty Crop Block Grant Program funds projects meant to enhance specialty crops’ competitiveness. Specialty crops include fruits, vegetables, tree nuts, horticultural and nursery crops, honey, maple syrup and hops. All projects should demonstrate that they benefit the specialty crop industry or public, not only one producer, and they require information dissemination or outreach work. The program funds work related to specialty crop research, education, food safety, pests and diseases and marketing and promotion.

Eligible applicants include individuals, individual producers, nonprofits and community-based organizations. Proposals may request up to $50,000 in grant funds, and no match is required. Allowable expenses include renting land, building space and equipment; website development; farm and production supplies; printing; and consulting fees. Requests may include personnel salary and fringe benefits costs, but their total must not exceed $15,000.

Food Insecure Cost-Share Grant

The Missouri Department of Agriculture’s Food Insecure Cost-Share Grant funds initiatives to increase food production and availability to people in qualified food-insecure urban areas. Grant funds reimburse expenses such as materials and equipment to reconstruct, build or expand facilities and approved project supplies. Applicants must demonstrate how a project will grow the local economy and reduce food insecurity in urban areas. Th e program will reimburse 75% of total approved project costs — up to $50,000 per project.

Urban Agriculture Cost-Share Grant

Offered annually by the Missouri Department of Agriculture, the Urban Agriculture Cost-Share Grant Program funds projects designed to develop small agribusinesses in Missouri’s urban areas. Grant funds reimburse expenses such as equipment, materials, business planning, marketing and supplies. Applicants may use funds to spur more agricultural production, value-added activity or workforce development. At a maximum, the program will reimburse 75% of total approved project costs — up to $10,000 per project.

Best practices to follow while preparing grant proposals

Most agricultural businesses require loans and personal investments as sources of financing. Those eligible for grants should view the grant funding as a supplemental source of funds to accomplish specific planning or business growth tasks. If you decide to seek out grant funding from a state or federal program, then be prepared to put in a lot of energy into the grant application in order to be competitive.

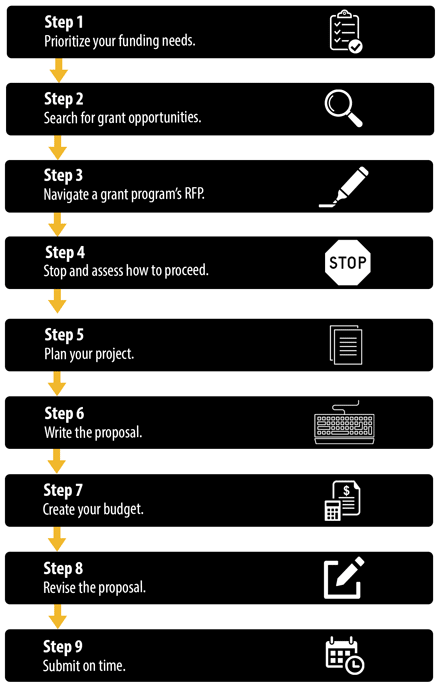

From an idea to proposal submission, the grant process has nine steps (Figure 1). By following best practices at each step, you increase the likelihood of receiving funding to support your business’ development.

1. Prioritize your funding needs

First, know what you want to achieve with grant funding. Most grant programs prefer to fund projects that yield measurable results (e.g., plan a business, add jobs, increase sales, reduce costs). When your goals are clear, you can better search for relevant grant programs.

Start by envisioning your business a few years from now. Then, note where grant funds could help you explore opportunities, answer questions or make investments. With most grant programs, funding is available once a year, programs take several months to make funding decisions, and you need a year or two to complete the project work. Thinking ahead can help you use grant funding effectively.

2. Search for grant opportunities

Next, look for grants that would fund your needs. This publication outlines several grant program possibilities. Consider talking with an extension professional, accountant and other agricultural experts who understand your goals and can help you identify options.

3. Navigate a grant program’s RFP

To gauge whether to apply for a grant, carefully read the full request for proposals (RFP) — also called a funding notice or request for applications (RFA). The RFP explains the program’s purpose, eligible applicants, allowable expenses, proposal expectations, submission deadlines and other rules to follow when creating proposals and budgets.

Print a copy of the RFP or RFA, or save the file to your computer. Then, highlight the key points. After your review, decide whether the program feels like a good fit for your needs and whether your idea meets the program requirements. Project ideas that align with a granting organization’s mission and priorities will more likely receive funding.

If you have questions while reviewing an RFP or RFA, then most programs list a program administrator. You can call or send an email to the appropriate contact to learn more about the particular program.

4. Stop and assess how to proceed

At this point, think critically about whether your funding needs and business interests align with available grant programs and timelines. Then, decide whether pursuing a grant is the right strategy.

Applying to a grant program doesn’t guarantee you will receive funds. Even if you decide to move forward with a grant application, consider alternative financing strategies, such as bank loans, personal equity, investors, crowdfunding and preselling products. You’ll likely need to explore multiple financing options to achieve your business goals.

5. Plan your grant project

After you identify a grant program to pursue, outline the project work. The work should positively impact your business and meet grant program expectations.

While planning, identify individuals or organizations who could support or provide expertise for your project. Some grant programs require a qualified independent contractor to develop deliverables (e.g., feasibility study, business plan, market study) funded by planning projects. You may rely on third-party expertise (e.g., website developer, consultants) to execute working capital projects. If you will build or buy infrastructure, then consider who to hire as vendors. You’ll want to introduce your team’s credentials in the proposal.

6. Write the proposal

The proposal gives you an opportunity to explain your idea and the need for it. Think of a proposal as a written “sales pitch” — why the grant program should fund your project. Your idea doesn’t have to be brand new, but it must allow for business opportunity in your geographic area or fit the grant program’s scope.

In the RFP or RFA, grant agencies will outline specific information to include in a proposal. Some programs also provide an application or proposal template to serve as a guide.

As you write, follow proposal instructions and answer all questions outlined in the RFP. Some grants provide the reviewer scoring framework, so carefully read and emphasize these components in your proposal. Observe limits on number of pages or margin sizes, and format text using the preferred size and font. Proposals that don’t adhere to the guidelines may be discarded.

7. Create your project budget

Budgets in grant proposals should present all expenses incurred to carry out the project work. You’ll likely need to collect bids or do research to ensure your funding request is reasonable, so start collecting your budget assumptions early.

The RFP or RFA will explain specific budget requirements. Often, grant programs provide budget tables or templates you can use. Do not include unallowable expenses, and do denote the source of any required matching funds.

In addition to the budget tables, some grant programs require a written budget justification, which explains why expenses are critical to the project and how you arrived at your budgeted costs. To justify travel expenses, for example, you should explain a trip’s purpose and dates; the individuals traveling; and the rates assumed for expenses such as mileage, airfare, meals and lodging.

8. Revise the proposal

Always edit a proposal before you submit it. You want to avoid making spelling, punctuation or grammatical mistakes. Even more importantly, you want to double-check your idea is clear and your work plan is logical. Sometimes, grant programs publish checklists or rubrics reviewers will use. Reference these materials to confirm your proposal includes all needed information.

Consider asking a friend, family member or extension professional who hasn’t seen the proposal to provide a review, too. A fresh perspective could help catch errors you may otherwise miss.

9. Submit on time

Most grant programs set hard submission deadlines and will not consider late submissions. Therefore, at a minimum, you want your proposal to arrive on time.

Submitting early can provide flexibility to work through any submission process roadblocks. For example, most grant programs accept electronic applications. If you planned to send your proposal via email or use an online submission portal, then you wouldn’t want a technology mishap to cause you to miss the deadline. Always verify that the funding agency receives the application.

What to expect after submitting a proposal

Depending on the granting agency, you may need to wait several weeks or several months to receive an official response about whether your proposal receives funding. The review process typically involves an appointed committee reading the submitted proposals and scoring them using a rubric. For state programs, an additional interview may be sought to address questions or provide further insight into your proposal.

If the agency awards grant funds to your project, then a program administrator will contact you to discuss next steps. Generally, those steps include executing a grant agreement and setting a project start date. After the project work begins, the grant agency typically will request periodic progress reports. In those reports, awardees explain where they have spent funds, what project milestones they have met and how they plan to proceed with the project. Awardees must also write a final report after the work is completed. In it, recap what the project accomplished and spent.

If your proposal isn’t selected for funding, then keep in mind that grant proposal success rates can be low, depending on the program. Many programs share comments to help you understand reviewers’ thoughts about the proposal. You may need to request the reviewer comments if the grant program doesn’t provide them to you. If you decide to reapply, then address reviewers’ feedback to strengthen the new submission.